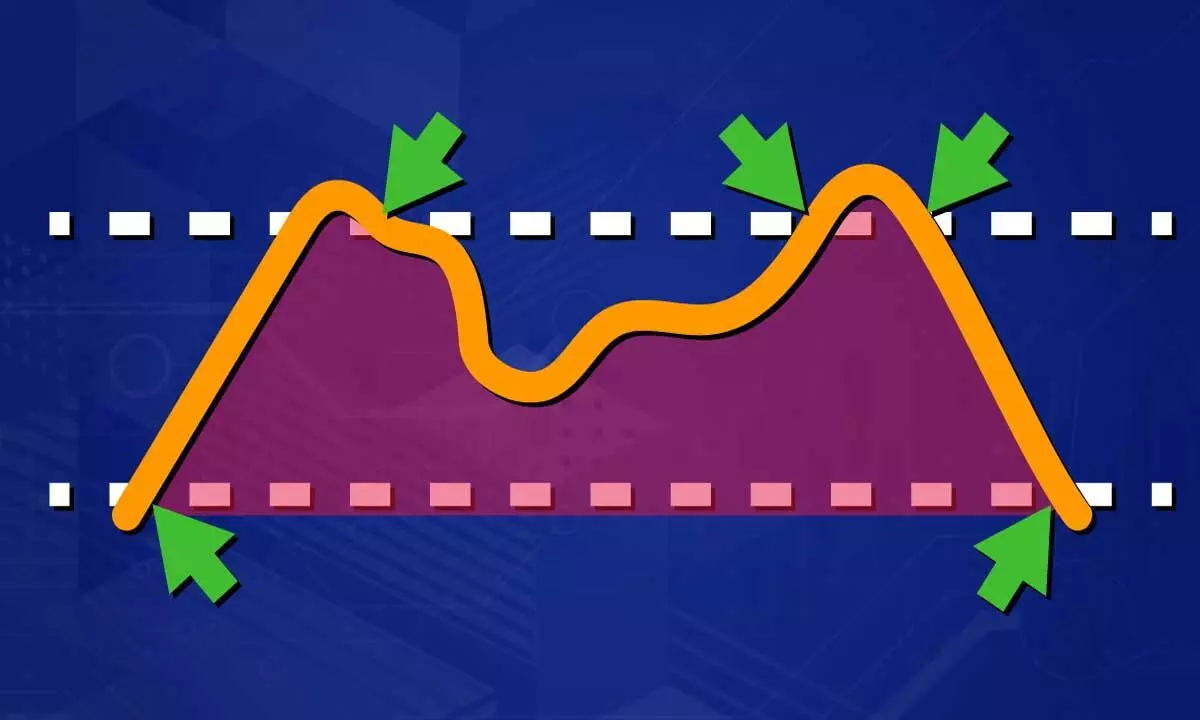

Weekly RSI shows negative divergence

Better to stay with a neutral bias with hedged positions

image for illustrative purpose

Now, for an upside move, the index must maintain positive closings for at least the next two days. In any case, if the Nifty closes below 23206, it may decline into the rising channel and the nearest support is at 22975, which is 8EMA. The 20DMA is at 22728, and the 50DMA of 22738 are the next level of key support

On a lacklustre trading day, NSE Nifty traded in just 105.7 points range and closed very flat. The Nifty closed with a just 5.65-points gain at 23,264.85 points. The CPSE, PSE, Oil and Gas, and Realty indices gained by 1.13 to 1.53 per cent. Nifty Pharma and FMCG indices are down by 0.43 per cent and 0.34 per cent, respectively. All other sectoral indices were gained or lost by 0.16 per cent to 0.83 per cent. The market breadth is positive as 1,697 advances and 965 declines. About 162 stocks hit a new 52-week high, and 173 stocks traded in the upper circuit. IRB. HDFC Bank, Indigo, and Idea were the top trading counters on Tuesday in terms of value. As expected, the Nifty tested the channel line and bounced. By closing marginally positive, it negated the Monday’s Shooting Star candle’s bearish implications. However, as the index formed a lower low and lower high, we can’t be bullish, either. The momentum is clearly waning. The index traded in the first hour’s range the whole day. The Volumes were subdued.

For the last three days, the RSI has been oscillating around 60, and the weekly RSI formed a lower swing high and showed a negative divergence. The hourly RSI has also declined into the neutral zone; the MACD has given a clear bearish signal. Now, for an upside move, the index must maintain positive closings for at least the next two days. In any case, if the Nifty closes below 23,206 points, it may decline into the rising channel. Below 23,206 points, the nearest support is at 22,975 points, which is 8EMA. The 20DMA is at 22,728 points, and the 50DMA of 22,738 are the next level of key support. In a nutshell, the index is not in the tradable zone on either side. As the volatility is collapsing, the neutral options strategies will work well. The India VIX and the Implied Volatility (IV) declined very fast after the event risks. For now, it is better to stay with a neutral bias with hedged positions.

(The author is Chief Mentor, Indus School of Technical Analysis, Financial Journalist, Technical Analyst, Trainer and Family Fund Manager)